NextGen

Prop Firm Tech

Provider.

Start your Prop Firm with those that know.

White Label

Fast Track

Pro Setup

Start Up

Enterprise

Established

Brokers

Solution

Fantasy Trading

Coming Soon

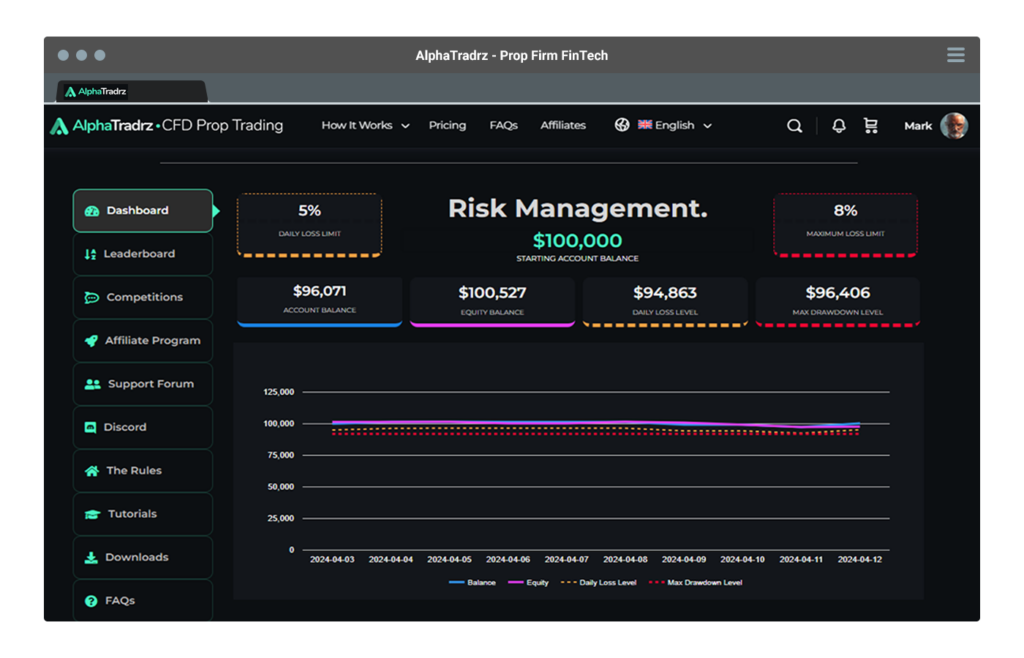

Trader Dashboard.

Integrated into your WordPress Sales Website.

- Risk Management

- Trader Performance

- Account Performance

- Leaderboard

- Competitions

- Affiliate Program

- Support Forums

- Discord

- Live Chat

- Rules & Limits

- Tutorials

- Downloads

- FAQ's

- Getting Started

- New Assessment/Challenge

- Reset

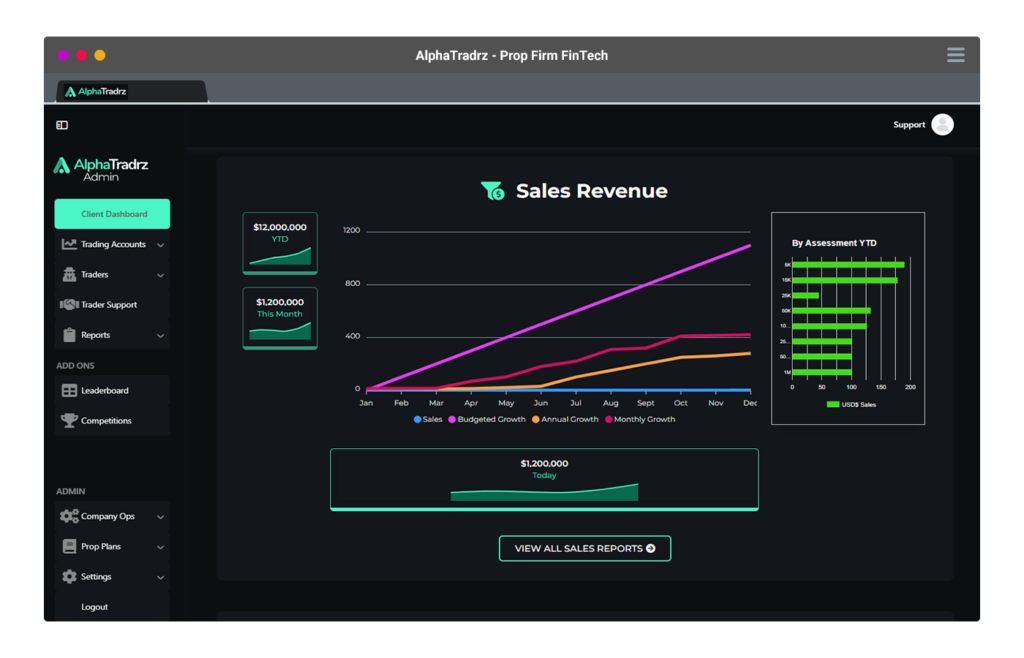

CRM Admin Dashboard.

Hosted on a separate domain name for maximum security.

Trader/User Management.

- Live Sales Revenue

- Traders Statistics

- User Statistics

- Risk Exposure

- Accounts Management

- Trader Management

- Trader Analytics

- Trader Support

- Leaderboards

- Competitions

Operations.

- Sales Reports

- Marketing Reports

- Risk Management

- SEO

- Website Analysitcs

- Challenge creation

Why use us?

2 Weeks Delivery!

Integrations.

Frequently Asked Questions.

What is a Prop Tech Firm?

A prop firm tech company develops and provides technology solutions specifically designed to support the operations of proprietary (prop) trading firms. These firms rely on fast, reliable, and data-driven tools to execute high-frequency trades, manage risk, analyze data, and streamline trading processes. Prop firm tech companies cater to these needs by offering advanced trading platforms, risk management systems, and data solutions that help prop trading firms maintain a competitive edge.

Key Functions of a Prop Firm Tech Company

Trading Platforms and Execution Systems

- Prop firm tech companies create high-performance trading platforms with low latency to enable fast and accurate trade execution. These platforms often provide direct market access (DMA), allowing traders to place orders directly on exchanges and trading venues.

Risk Management Systems

- These tech companies develop software to manage and monitor risk in real-time, implementing parameters like daily loss limits, maximum drawdowns, and other automated controls that prevent excessive losses and protect firm capital.

Algorithmic and Quantitative Trading Solutions

- Prop firm tech companies offer environments and tools for developing, backtesting, and deploying algorithmic trading strategies. This might include APIs, coding environments (e.g., Python or R), or customizable algorithm libraries for traders to create data-driven strategies.

Market Data and Analytics

- Access to high-quality, real-time data is crucial for prop trading firms. Tech companies in this space provide data feeds, analytics tools, and dashboards for tracking price movements, identifying patterns, and making informed decisions. They may also incorporate historical data for backtesting.

Performance Analytics and Trader Evaluation Tools

- These companies build performance tracking tools that measure trading metrics, such as profitability, consistency, and risk adherence. Prop firms use this data to assess traders’ performance, make funding decisions, and offer targeted support to improve trading success.

Cloud Infrastructure and Scalability Solutions

- Many prop firm tech companies provide cloud-based trading environments, which allow firms to scale their operations without heavy hardware investments. Cloud infrastructure supports remote trading, high-frequency trading, and rapid data processing across global markets.

Security and Compliance Solutions

- Prop firm tech companies develop and implement security protocols to protect trading data and financial information. This includes multi-factor authentication, encryption, and secure access measures. They may also build compliance tools that ensure adherence to financial regulations and reporting requirements.

Automated Trading Tools and Strategy Optimization

- These firms offer tools that automate trading processes, such as executing trades based on specific conditions or optimizing strategies in real time based on market movements. Machine learning and AI are sometimes incorporated to enhance trading accuracy and optimize strategy performance.

Benefits for Prop Trading Firms

- Speed and Efficiency: Advanced tech reduces latency in trade executions, enabling firms to capitalize on market opportunities with high speed and efficiency.

- Risk Mitigation: Real-time risk management software protects firm capital, enforcing strict trading protocols to prevent excessive losses.

- Enhanced Trader Performance: Performance analytics allow firms to track traders’ progress, providing insights to support development and improving profitability.

- Scalability and Flexibility: Cloud-based solutions and API integrations enable prop trading firms to scale operations and adapt quickly to changes in the market environment.

- Data-Driven Decision Making: Access to real-time data feeds and analytics tools allows firms to base decisions on actionable insights, improving trading outcomes.

Prop firm tech companies play a critical role in enabling proprietary trading firms to operate with precision, speed, and security, making them vital to the firm’s success and competitive advantage.

Howlong does it take to launch your new prop firm?

We allow 2 weeks to create and test your server. If you are including a website built for you then please allow 3 weeks.

Depending on our workload this can be significantly reduced.